Successful trading starts with convenient and functional trading.

Metatrader 5 is the best choice for the modern trader.

MetaTrader 5 (MT5) is a powerful trading platform that supports Forex, Futures, Stocks, and Cryptocurrency trading. This guide will walk you through the installation process for MetaTrader 5 on Windows.

1

Download MetaTrader 5

Download the MetaTrader 5 installation file from the official website or your broker’s download page.

Some brokers provide customized versions, so ensure that you download the version suited for your trading needs.

2

Run the Installer

Open the downloaded .exe installation file to launch the setup wizard.

The End-User License Agreement window will appear. Read the terms and click “Next” to proceed.

Choose the default installation path or specify a different folder.Click “Install” to begin the automatic installation process.

3

Installation Process

Once the installation is complete, click “Finish”, and MetaTrader 5 will launch automatically.

Upon the first launch, you will see the server selection screen, where you can create a new account or log in to an existing one.

4

Setting Up Your Trading Environment

n the Market Watch window, add your preferred trading instruments and customize the chart settings.

Use the Navigator panel to connect your trading account and manage indicators, expert advisors, and scripts.

5

Click the “New Order” button to select a financial instrument and execute a trade.

Configure Stop-Loss (SL) and Take-Profit (TP) levels to manage risk effectively.

Start Trading

HOW to Use MT5

MetaTrader 5 (MT5), Developed by MetaQuotes Software, MT5 provides powerful tools, a user-friendly interface, and a highly customizable trading environment.

In this guide, we will explore how to trade on MT5, its key features, and how traders can maximize their efficiency using its advanced tools.

1

Adding Trading Instruments

Arranging the Trading Screen & Keyboard Shortcuts

-

When you connect to the XM Server, the default trading screen will appear.

To quickly organize the layout for better visibility, click the grid icon at the top right corner. This will automatically align all the windows neatly.

Adding/Searching for Trading Instruments in MT5

By default, XM displays only eight instruments on the trading screen.

Therefore, the first step after installing MetaTrader 5 is to add more trading instruments.

-

Shortcut Key: Alt + R

-

Ultra-Low Account Notice: If you are using an Ultra-Low account instead of a Standard account, the instrument names will have a # (hash) symbol at the end.

Adding Major Forex Pairs

-

To add major currency pairs, follow these steps:

-

Press Ctrl + U on your keyboard OR go to "View" > "Symbols" from the top menu.

-

In the left tree menu, double-click on the desired category.

-

Locate the sub-category and double-click it to view the list of available instruments.

-

Instruments highlighted in yellow are currently active and will appear in the Market Watch panel on the left.

-

Double-click on any instrument to activate it (yellow highlight).

-

To remove an instrument, double-click again to deactivate it.

Adding Index CFDs (Nasdaq, Hang Seng, etc.)

-

To add index instruments like Nasdaq (US100) or Hang Seng, follow these steps:

-

In the Symbols window (Ctrl + U), find the "CFDs" category.

-

Expand the "Indices" sub-category.

-

Locate the index you want to trade and double-click to activate it.

-

By following these steps, you can customize your Market Watch panel and easily access the instruments you need for trading.

2

Placing Orders in MT5

Placing an Order via Market Watch (Ctrl + M)

-

To quickly place an order, follow these steps:

-

Press Ctrl + M to open the Market Watch panel on the left.

-

Double-click on the instrument you want to trade.

-

The Order Window will appear, where you can choose order types such as:

-

Market Execution (Instant Order)

-

Pending Orders (Limit, Stop, and Stop-Limit Orders)

Placing an Order via the Chart (Right-Click Menu)

-

Another way to place an order is directly from the chart window:

-

Right-click anywhere on the chart.

-

Select "Trading" → "New Order" from the menu.

-

This will open the same Order Window as in the Market Watch method.

-

Shortcut Key: F9 (Function Key)

Using the "Toolbox" (Ctrl + T) for Trade Management

-

The Toolbox in MT5 is essential for monitoring active trades. You can access it by:

-

Clicking on "View" → "Toolbox" in the top menu

-

Using the shortcut Ctrl + T

3

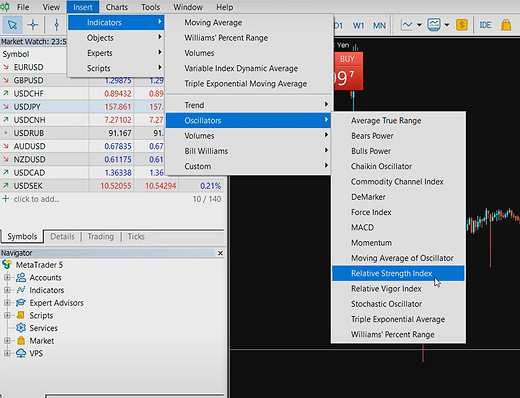

Understanding Technical Indicators

hese indicators help identify price movements, trends, and potential entry or exit points for trades. While no single indicator guarantees success, combining multiple indicators enhances the accuracy of predictions and minimizes risks.

Moving Average (MA)

A Moving Average (MA) smooths out price fluctuations over a set period, helping traders identify the overall trend direction. It reduces noise from short-term price movements and provides a clearer picture of market trends.

Types of Moving Averages:

-

Short-Term MA (Below 20 days): Reacts quickly to price changes and is useful for identifying immediate trends.

-

Medium-Term MA (20-100 days): Helps detect intermediate trends and provides a balanced view.

-

Long-Term MA (Above 100 days): Used to identify major market trends and is typically used by long-term investors.

How to Use It in Trading?

-

When the short-term MA crosses above the long-term MA, it signals a buy opportunity (golden cross).

-

When the short-term MA crosses below the long-term MA, it signals a sell opportunity (death cross).

-

MAs also act as support and resistance levels.

Relative Strength Index (RSI)

The Relative Strength Index (RSI) is a momentum indicator that measures the strength and speed of price movements. It compares recent gains and losses to determine whether an asset is overbought or oversold.

How to Use RSI in Trading?

-

RSI below 30: The asset is considered oversold, meaning it may be undervalued and due for a potential price increase.

-

RSI above 70: The asset is considered overbought, meaning it may be overvalued and could experience a price correction.

-

RSI between 30-70: Indicates a neutral market condition with no strong buy or sell signals.

RSI Trading Strategy

-

Look for RSI divergence: If the price makes a new high but RSI does not, it may indicate a trend reversal.

-

RSI works best when used with other indicators, such as Moving Averages.

Moving Average Convergence Divergence (MACD)

The Moving Average Convergence Divergence (MACD) indicator helps traders identify trend direction and momentum. It consists of two moving averages:

-

MACD Line (Fast Line): The difference between the short-term (12-day) and long-term (26-day) Exponential Moving Averages (EMAs).

-

Signal Line (Slow Line): A 9-day EMA of the MACD line.

How to Use MACD in Trading?

-

Bullish Signal (Buy Opportunity): When the MACD line crosses above the signal line.

-

Bearish Signal (Sell Opportunity): When the MACD line crosses below the signal line.

-

Divergence: If the MACD moves in the opposite direction of the price, it may indicate a trend reversal.

Best Practices

-

Use MACD in combination with RSI or Moving Averages for stronger confirmation.

-

The histogram (bar chart) shows the strength of the trend—larger bars indicate stronger momentum.

Trailing Stop

A Trailing Stop is a dynamic stop-loss order that moves in the direction of the trade. Unlike a fixed stop-loss, it allows traders to lock in profits while letting their trades continue running if the price moves favorably.

How to Use Trailing Stops?

-

If you are in a buy trade, the trailing stop moves upward as the price increases.

-

If you are in a sell trade, the trailing stop moves downward as the price decreases.

-

When the price reverses by a set percentage or amount, the stop order triggers, securing the profit.

Why is it Useful?

-

Protects profits by adjusting dynamically with market movements.

-

Minimizes risk without limiting the upside potential.

-

Best used in volatile markets where prices fluctuate frequently.